City Hive strengthens ACT governance with new Stewardship Council and senior adviser

ACT Stewardship Council for institutional market unveiled

RBC BlueBay AM CEO Erich Gerth appointed senior adviser

Deputy chair and governance committee created for ACT Stewardship Council

ACT Global Leadership Council divided into workstreams

Think tank and advocacy group City Hive in the investment industry is proud to announce a series of enhancements to the governance of the ACT Framework and Standard. The changes reinforce ACT’s credibility, accountability and global reach.

ACT for institutional market

Firstly, City Hive is delighted to unveil the ACT Stewardship Council for the institutional market expanding oversight into pensions, charities, endowments and insurers. Akin to the existing members of the ACT Stewardship Council focused on the wholesale market, the new members will have oversight of the ACT Framework and consider how adoption is expanded into institutional industry practice to drive progress and results over time. This development also supports the global expansion of the Framework.

Founding members include:

Debbie Clarke, consultant and non-executive director

Jo Holden, head of manager research, Mercer Global

Paul Carne, EMEA delegated chief investment officer, AON

Phil Edwards, head of manager selection and oversight, USS

City Hive will continue recruiting additional members from across its Signatory firms.

Paul Carne said: “ACT has had a positive impact in the wholesale market by championing higher standards of stewardship, transparency, and ethical behaviour across the investment industry.

“I believe ACT can have a similarly transformative influence on the institutional market, benefiting pension schemes, charities, endowments, and insurers alike. ACT’s commitment to fostering a strong and ethical culture closely aligns with my own values and professional experience. By supporting ACT, we have the opportunity to drive positive change, raise industry standards, and ensure that the interests of clients and stakeholders are always put first.”

Jo Holden commented: “ACT represents a pragmatic way of raising standards without being overly prescriptive. There is no box-ticking – no sense of completing the assessment, getting a gold star and feeling as though the job is done. Encouraging asset managers to self-assess, to evolve in a way that reflects their own aspirations and at their own speed where culture is concerned, and giving them a tool to discuss and engage with asset owners is a very healthy approach I think.”

Debbie Clarke added: “Having researched asset managers for over 20 years, an assessment of culture has always been key. ACT assists clients in determining if the firm and team they entrust their assets to will still be acting in their best interests for the foreseeable future.”

Senior adviser appointed

Erich Gerth, CEO at RBC Bluebay Asset Management, has been appointed senior adviser to City Hive and ACT.

Erich commented: “As one of the first signatories to the ACT Framework, RBC BlueBay has continued to maintain close ties to City Hive’s ACT, the corporate culture standard for investment companies.

“Being able to proactively present our culture to our prospects and clients within this space, and in a way that allows them to like-for-like assess us against our peers, is an area we feel confident in and helps to cultivate an industry that is centred on transparency. The latter being something I personally feel very passionate about.

“That is why, when Bev Shah, one of the architects behind ACT, asked if I would be willing to take up the role of senior adviser to City Hive and ACT, I didn’t hesitate to say yes.

“I am very much looking forward to driving ACT’s mission to enhance transparency, accountability, and strategic direction across the investment landscape.”

ACT Stewardship Council vice chair and Governance Committee

To enhance leadership on the existing ACT Stewardship Council, Jake Moeller, associate director, responsible investment at Square Mile Titan, has been appointed vice chair of the ACT Stewardship Council, supporting Emma Wall, who serves as chair and is also chief investment strategist at Hargreaves Lansdown.

Jake Moeller commented: “City Hive is dedicated to fostering fund manager openness, raising fiduciary standards and improving fund selector dialogues. I am proud to continue to be an advocate of their important work to benefit investor outcomes.”

The ACT Stewardship Council is an essential part of the ACT Standard’s governance, providing challenge and support on coverage, quality and completeness of the standard, and its credibility and applicability to industry practice.

Further, Ben Seager-Scott, chief investment officer at Forviz Mazars, has been appointed chair of the ACT Governance Committee and Genevra Banszky von Ambroz, fund manager at Evelyn Partners, as vice chair of the ACT Governance Committee.

Ben commented: “It is difficult to overstate the importance of culture in the investment industry, and I believe good culture goes hand in hand with good governance. Just as we expect transparency and effective governance as foundational to positive culture in ACT Signatories, we have established the Governance Committee to ensure we hold ourselves to these same high standards."

Their responsibilities include providing independent, relevant and evidence-based insights on governance processes around the Framework and Standard.

ACT Global Leadership Council

Meanwhile, the ACT Global Leadership Council, a body of senior industry figures providing strategic oversight to embed and grow the standard globally, will now operate through targeted workstreams based on role and responsibility. The ACT Global Leadership Council is chaired by David Coombs, manager of the Rathbones Multi Asset Portfolio Funds.

Global Leadership Council Workstreams

Signatory members include:

Chris Anker, head of stewardship, Redwheel

Sachin Bhatia, head of UK institutional & EMEA consultant relations, Invesco

Justin Onuekwusi, CIO, St. James’s Place

Matt Rawlings, head of financial institutions, RBC BlueBay Asset Management

Pauline Bush, head of marketing - investments, Aberdeen

Emma Wall, chief investment strategist, Hargreaves Lansdown

Sam Pennefather, head of intermediary sales, CCLA Investment Management

Selina Tyler, head of UK, Jupiter Asset Management

Academy members:

Karina Langan, head of HR, TT International

ACT Alliance members:

Annabel Brodie-Smith, director of communications, AIC

Beth Northey, business development director, PAM Insight

Dan Gilmore, head of sales, Owen James

Katrina Lloyd, editor-in-chief, Incisive Media

Natalie Kenway, freelance journalist, Kenway Content & Consulting

Olivier Lebleu, senior adviser, Edelman Smithfield

Shilpan Patel, head of sales & client relations (EMEA) at DOOR Ventures

Bev Shah and Mandy Kirby, co-CEOs of City Hive, commented on the enhanced governance of ACT: “We welcome the enhanced governance structure for ACT, which adds robustness and brings fresh insights from across the ecosystem. With these additions, we are better equipped to manage risks to the standard and are positioned to deliver meaningful, accountable impact for the industry.”

Notes:

For more information on ACT, interview opportunities and photos please email: nataliekenway@cityhive.co.uk or visit the City Hive Press Centre.

For more information on ACT: https://www.investorsact.com/

Or for the Stewardship Council: https://www.investorsact.com/stewardship-council

For more information on City Hive: https://www.cityhive.co.uk/

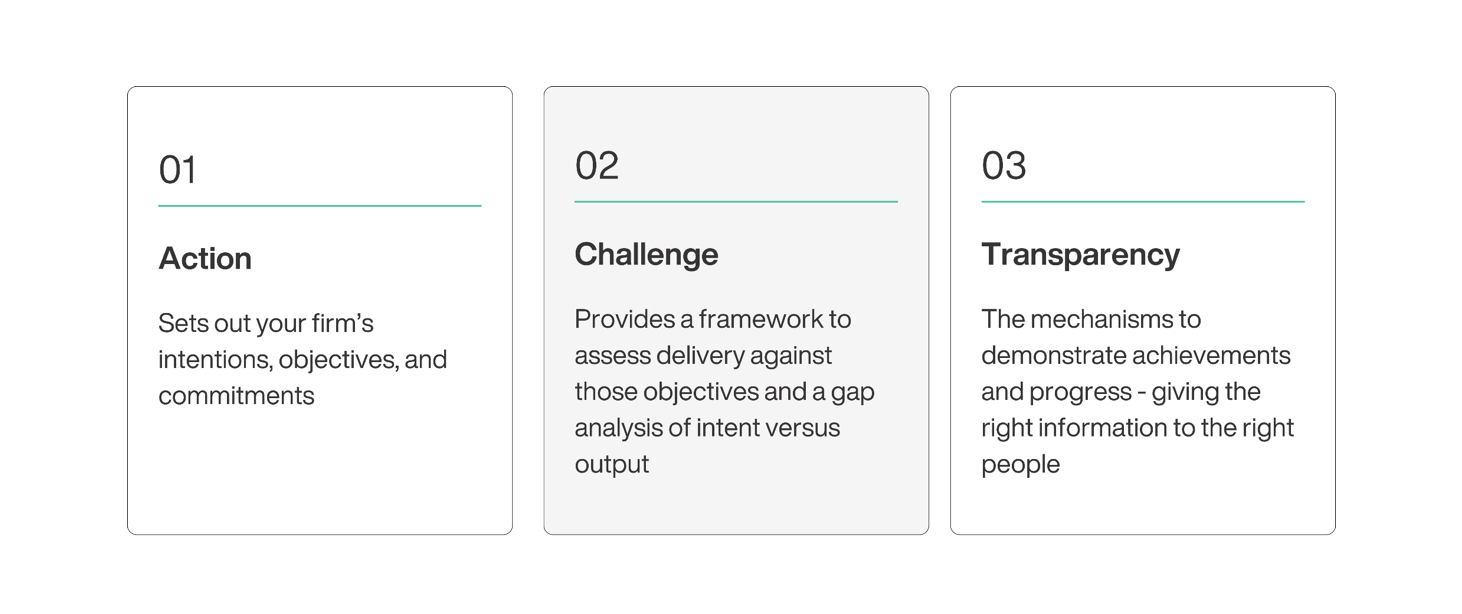

The ACT Framework is comprised of three key pillars, each with three components: